Home Owners Loan Act 1933

Table of Content

Treasury, the HOLC was authorized to issue $2 billion in bonds, an amount eventually increased to $4.75 billion. During a peak period in the spring of 1934, it processed over 35,000 loan applications per week and employed almost 21,000 people in 458 offices throughout the country. The law authorizing the HOLC's lending activities expired on June 12, 1936. By that time, the HOLC had made 1,021,587 loans, making it the owner of approximately one-sixth of the urban home mortgage debt in the United States.

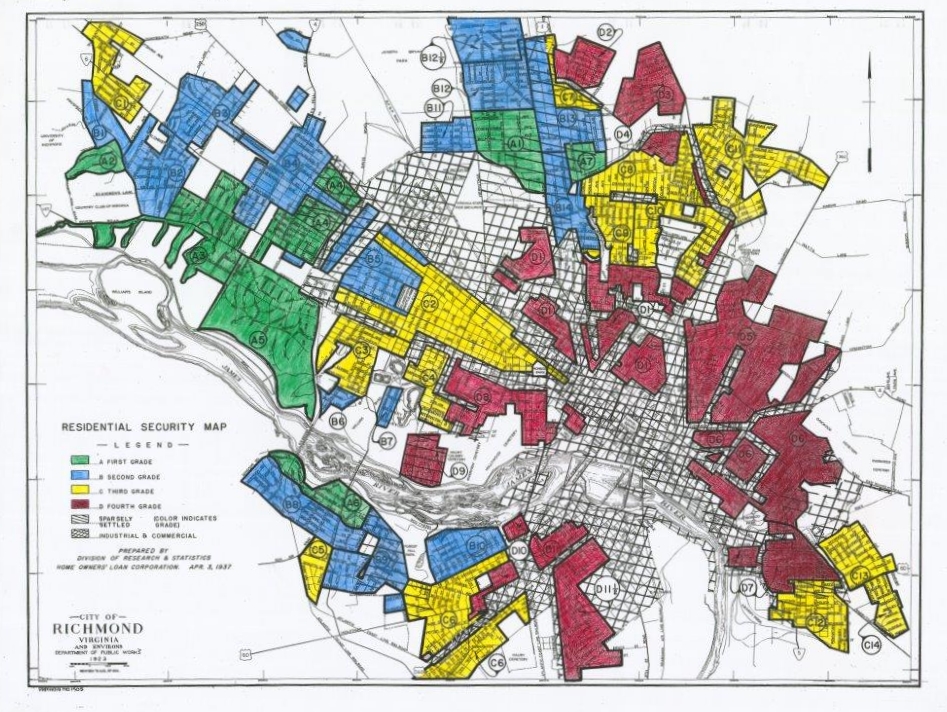

HOLC is often cited as the originator of mortgage redlining, although, this claim has also been disputed.

Home Owners' Loan Corporation Law and Legal Definition

During the 1920s lenders and debtors entered into home mortgage arrangements with “confidence that the burden could be supported without undue difficulty…”, but an enormous real estate bubble arose that badly overextended both banks and home buyers. The Home Owners’ Loan Act of 1933 proved to be one of the most successful policies emanating from the first 100 days of the New Deal. Not only did its program of emergency lending rescue hundreds of thousands of home owners and mortgage institutions from loss, it and the Federal Housing Administration , created a year after HOLC, completely transformed the US mortgage market. It replaced the short-term mortgages and purchase contracts of the 1920s, with their high interest rates and higher risk of default, by long-term mortgages at lower rates of interest backed by the federal government.

The HOLC, for example, might refinance a $10,000 mortgage as if the initial amount loaned to the home owner had been $9,300, but that figure—$9,300—could still be significantly higher than the current deflated market value of the property. Under this arrangement, lenders only had to forego a small part of their capital, plus they received government-backed bonds in place of frozen mortgages. On the other hand, by propping up the face values of its refinanced mortgages, the HOLC compelled home owners to repay inflated 1920s mortgage loans with deflated 1930s wages.

How to Get Educational Loan Abroad Without Collateral

This federal emergency agency offered mortgage assistance to homeowners by lending low-interest funds to refinance mortgages, as well as creating new mortgages. HOLC issued bonds insured by the government to local lenders to pay for delinquent mortgages on their portfolios. The HOLC issued bonds and used the bonds to acquire loan mortgages from lending institutions. The loans were purchased to homeowners who were having difficulties paying the bills on the mortgage loan “through not their fault”. A majority of the lenders profited from selling their loans since the HOLC bought the loans offering bonds with a value equal to the principal due by the borrower.

It allowed year olds to enlist in work programs to improve America's public land, parks and forests. Social Security Administration The SSA helped provide for unemployment insurance, old-age insurance, and means-tested welfare programs. The Great Depression was a "catalyst" for the Social Security Act of 1935. Bridged Definition bridge definition and synonyms

FDIC: Federal Deposit Insurance Corporation

Its purpose was to refinance home mortgages currently in default to prevent foreclosure, as well as to expand home buying opportunities. This home is purchased from people who had trouble paying their mortgage loans. Which is then refinanced, the home gets refurbished, and then rented out or resold. What is another word for home owners loan corporation definition? This is the right place where you will get the right information "home owners loan corporation definition".

However, check home owners loan corporation definition at our online dictionary below. Was a state-sponsored corporation that was established as part of the New Deal. The company was founded in 1933 under the Home Owners Loan Corporation Act under the direction of president Franklin D. Roosevelt. The purpose of the corporation was to help refinance mortgages on homes that were in default, preventing foreclosure and to broaden the opportunities for homebuyers. Finally, you got the answer of home owners loan corporation definition in this article.

Was the HOLC a reform?

Within three years, In the span of three years, the HOLC reimbursed mortgages with outstanding payments of over 1 million families that had loans for long-term duration with lower rates of interest. The loans, which were subsequent advances, totaled approximately $3 billion. These funds did not only keep families from being in foreclosure. The home owners' loan corporation was a fed. eral program established in 1933 to provide relief to distressed residential mortgage.

HOLC officially ceased operations in 1951, when its last assets were sold to private lenders. HOLC was only applicable to nonfarm homes, worth less than $20,000. HOLC also assisted mortgage lenders by refinancing problematic loans and increasing the institutions' liquidity. When its last assets were sold in 1951, HOLC turned a small profit. Some commentators, however, criticized the HOLC's practice of indirectly assisting home owners through programs that directly aided mortgage lenders. The urban reformer Charles Abrams pointed out that, on average, the HOLC refinanced the mortgages it purchased for only 7 percent less than the previous, admittedly inflated, value of the property in question .

Check our encyclopedia for a gloss on thousands of topics from biographies to the table of elements. Brush up on your geography and finally learn what countries are in Eastern Europe with our maps. DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

The HOLC was unable to make loans in the future and focused instead on repayments of loans. It is important to note that the B&L was a direct reduction loan where certain amounts of principal was due every month. Consequently, the term of the loan could not change unless the loanee did not pay the loan. Congress to maintain stability and public confidence in the nation's financial system. During this period, HOLC made over 1 million loans totaling about $3.1 billion – $575 million of which went to individuals .

Farm Security Administration The FSA resettled poor farmers on more productive land, promoted soil conservation, provided emergency relief and loaned money to help fanners buy and improve farms. HOLC also supported the mortgage industry by refinancing difficult loans and also increasing the institution’s liquidity. The Home Owners' Loan Corporation was a government-sponsored corporation created as part of the New Deal. HOLC was established as an emergency agency under Federal Home Loan Bank Board supervision by the Home Owners' Loan Act of 1933, June 13, 1933. It was transferred with FHLBB and its components to the Federal Loan Agency by Reorganization Plan No. It was assigned with other components of abolished FHLBB to the Federal Home Loan Bank Administration , National Housing Agency, by EO 9070, February 24, 1942.

According to a paper by economic historian Price V. Fishback and three co-authors, issued in 2021, the blame placed on HOLC is misplaced. The pattern of loans had basically no relationship to the "redlining" maps because the program to create the maps did not even begin until after 90% of HOLC refinancing agreements had already been concluded. As for private lenders, though Kenneth T. Jackson's claim that they relied on the HOLC's maps to implement their own discriminatory practices has been widely repeated, the evidence is weak that private lenders even had access to the maps. By contrast, it is well documented that private lenders understood which neighborhoods the FHA favored and disfavored; suburban greenfield developers often explicitly advertised the FHA-insurability of their properties in ads for prospective buyers. Long-term racial discrimination caused by the HOLC leaves lasting long-term impacts on a population's health, education, and income. Home Owners' Loan Corporation , former U.S. government agency established in 1933 to help stabilize real estate that had depreciated during the depression and to refinance the urban mortgage debt.

Comments

Post a Comment